The Rising Philippines Gambling Market - Current State and Opportunities

A market that is not widely talked about, which yet may still divide opinion, the Philippines is known mainly for, firstly, manufacturing for the West because of cheap labor costs and, most recently, its tourism trade, which, over the last couple of years has started to put the country on the map.

Boasting in excess of 7,000 islands, many officially uninhabited, thousands have begun to flock there every year from all around the globe. However, one industry that could well muscle in on this and even take advantage of tourism is one that has existed for quite a while, albeit somewhat under the radar.

Gambling in the Philippines is one of those activities, like for many Asian countries, has become somewhat a part of life; introduced to the country by Chinese traders as far back as the 16th century.

There have, of course, been unsavory links surrounding the gambling market in the country, with this often being associated with organized crime, racketeering, money laundering and even kidnapping, events which appear to be a thing of the far distant past. With a politically stable government in place for over two decades, this has provided a healthy foundation for industry and an ever-increasing economy since.

Thriving Gambling Market and Position of PAGCOR

Over the last couple of decades, the number of brick-and-mortar casinos in the country has exploded; aided particularly by foreign investors, many of whom were quick to recognize the considerable potential for a significant return on investment.

Some of the heavily invested companies over the last few years include, but are not limited to, Travellers International Hotel Group, Alliance Global, Bloomberry Resorts, Melco Resorts, Belle Corporation and Tiger Resorts; many of these having been able to capitalize on the steadily booming tourist trade.

And then, of course, there is PAGCOR (Philippine Amusement and Gaming Corp), a group native to the country, which has a substantial amount of influence. Indeed, under its umbrella, it is understood that the group has 44 state-owned casinos in its portfolio, with these generating 15.9 billion pesos in gross gaming revenue (GGR) last year, according to its website.

Ultimately, the Philippines is thriving; arguably one of the biggest gambling markets in Southeast Asia and all signs point to this growing even more. However, the recent global pandemic caused a significant amount of unrest and uncertainty in the industry; certainly, state-owned establishments and those related to PAGCOR felt the squeeze.

As opposed to foreign investors, many of whom are backed by private equity firms with vast resources, PAGCOR is limited. It is believed that the group is exploring the privatization of its assets, which will most likely be sold to the highest bidders, with the group essentially refocusing on becoming the gambling regulation of the market and raising investment for President Ferdinand Marcos Jr.'s ambitious sovereign wealth fund.

We are seriously considering the privatization of all PAGCOR-operated casinos. We are the only regulatory [body] in the world that doesn't only regulate; we also operate casinos. It's very ironic that that is the case.

To be so ‘matter of fact’ about this statement makes it hard not to recognize potential overtones, which, certainly in a Westernized market, may attract substantial scrutiny and even raise concerns around fairness and impartiality.

Interest of Foreign Investors in the Philippines

A question, no doubt, that most of you may have asked yourselves up to this point; it is actually easy to understand why there is such a draw for foreign investors in the gambling industry.

With land and real estate are considered to be substantially cheaper than in countries such as the US; this is one of the reasons why this makes it such a great investment for wealthy outside investors, particularly US-based gambling groups with attractive balance sheets.

The country has also proven considerably robust from a gambling perspective, whether this be in terms of locals or tourists as potential customers. According to a recent study led by Mr. Marvin Castell and Mr. Joel Tanchuco, assistant professors of the Economics Department at the College of Business, De La Salle University, despite 63 percent of Filipinos being morally opposed to the idea of gambling, 59 percent of the population still continue to engage in it.

For outside investors, this can be perceived as good news; indeed, the study also went on to outline that Filipinos see gambling as the only plausible alternative to try and get ahead because of the low-interest rates that banks have imposed, in addition to the financial risks of starting a business in the country.

As such, for many, gambling is seen as somewhat of a ‘necessary evil’ - of course, there are many who do actually enjoy it, this usually being the case of players who gamble for fun and do not necessarily need to win big, because they are already wealthy.

Role of Chinese Tourists on Philippines Gambling

The significant influx of Chinese tourists to the Philippines in recent years has also aided many investors’ decisions. Often, these are salubrious individuals with surplus disposable income that flock to the Philippines because they see it as a better value alternative to gambling in Macau.

For many, baccarat is the game of choice, with many of these tables dominating many a casino in the country in a bid to attract wealthy Chinese tourists, who will often gamble large amounts at a time.

Outside investors also know that they can capitalize on the local workforce and pay considerably lower rates than they would need to in Westernized countries; indeed, this factor alone can contribute towards a large part of their return on investment (ROI) after just one year.

The Philippines is also becoming well-renowned for its improvement of physical and digital infrastructure, which provides foreign investors with a lot of positivity for the live casino element of the industry.

Over the last few years, the country has improved its broadband facilities, with telecommunications now playing a major role as one of the Philippines’ premier and most important industries. As a result, the country has seen its internet speed get faster over the last couple of years, with a considerable amount of money having been invested.

This, of course, is crucial to any hope of a thriving online gambling sector in the country, something that investors have been quick to identify with, especially those companies led by Chinese-backed consortiums.

Gambling in China is forbidden, and many Southeast Asian countries like Cambodia, Vietnam and Malaysia have folded under pressure from President Xi Jinping’s government, while his personal request in 2019 for gambling to be banned in the Philippines fell on deaf ears. Then President Rodrigo Duterte reasoned the billions in pesos generated by the industry as the main driver for still allowing this.

Future of the Philippines Gambling Market

Over the next few years, this is certainly one market that will attract a substantial amount of attention, albeit just from a spectator perspective. There are likely going to be many in the iGaming industry who will be curious to what extent the market will be successful.

A lot of attention could well be paid to the societal pressures that may overburden the country and force the President into a considerable rethink or certainly influence the gambling industry's regulation.

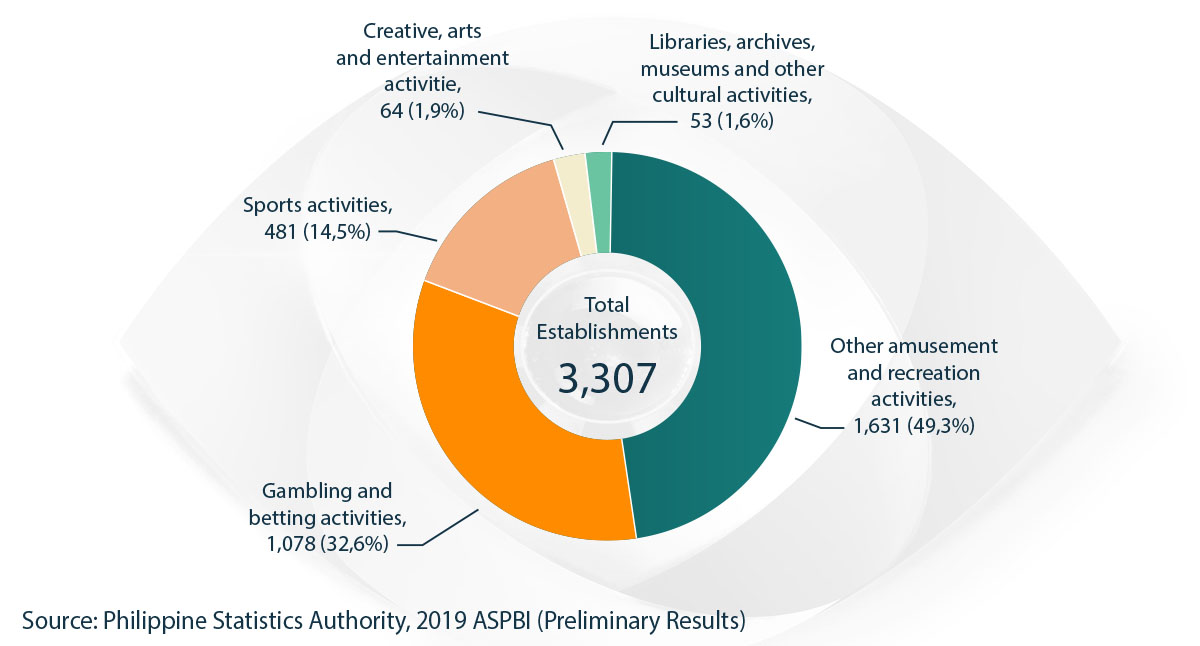

Currently, according to the Philippine Statistics Authority (PSA), gambling companies contributed Php 205.52 billion in 2019; 85.1 percent - this being the highest share contribution from the Arts, Entertainment and Recreation sector in the country.

Arguably some of the most prevalent gambling companies in the Philippines are (Philippine Offshore Gambling Operator) POGO-orientated, which are mostly the subject of foreign influence, especially Chinese investors, looking to cater to the market and nearby countries such as Singapore.

Indeed, in allowing Philippine Offshore Gambling Operators in the country, former president, Duterte intimated that it was a decision that, quite simply, he had to back, citing economic pressure following the global pandemic as the biggest reason: “Now, why did I allow gambling? It’s because we don’t have money.” the president said.

“The most sensible thing is really just to encourage those activities (gambling), though it may sound not really repulsive but maybe repugnant to some,” he added.

Annually, POGOs contribute Php 34.67 billion towards the Filippino economy; this being the equivalent of one percent of the country’s gross domestic product (GDP). Meanwhile, PAGCOR pays five percent in tax to the Bureau of Internal Revenue, with half of the remaining 95 percent being contributed to the Bureau of the Treasury. As a result, this is then utilized for the budgets of the Philippine Sports Commission, the Philippine Board of Claims and the Office of the President’s Project for Social Funds.

Regarding revenue from land-based casinos in the country, it is the host city, local government units (LGU), that benefit.

As a result, the macroeconomic benefits that have derived from this taxation have proven to be substantially effective over the last few years, enabling local authorities to contribute towards improving infrastructure in the country.

Disregarding a large source of income, such as the gambling industry, could end up being disastrous for the new president, especially if there is no way to replace this - certainly, every indication so far, particularly from a privatization standpoint, might suggest otherwise.

Despite this, there have been calls in the last 12 months to completely ban POGOs from operating in the country, with a proposal being submitted last September, with Senate Minority Leader Aquilino Pimentel III, understood to be a main and very vocal driver behind this.

There is overwhelming support for a change in the existing policy, and a change in the existing rules and regulations, as well as a change in the existing attitude in law enforcement. The problem is in the enforcement of a policy, which is so elaborate, andaming mga (there are so many) conditions or special provisions.

All may well depend on what the plans are for this new sovereign wealth fund and how it will be invested before the future of the Philippine gambling industry can be decided in detail and with finite precision.

Every indication so far suggests that the gambling industry will continue to play a major part in the country’s economy for at least the next few years. Investors, though, should rightfully be cautious about the types of decisions that they make, especially when weighing up whether land-based or digital is the best direction to go in.

Will the Philippines Become the Next Macau?

Whisper it carefully. This could very well become a distinct possibility. As touched upon, Chinese gamblers already are seemingly ditching the province, as Xi Jinping looks to crack down on high-rollers, despite billions of dollars of investment being committed by major gambling companies recently.

And, it is not just Chinese gamblers who appear to have become disillusioned with Macau. Indeed, wealthy South Koreans and Japanese see the Philippines as a viable alternative for their gambling needs, with Singapore also being high on their list.

It is easy to understand why potential (or even current) investors may think of the Philippines as the next Macau or, indeed, the gambling epicenter of Southeast Asia.

“Singapore and the Philippines are growing exponentially,” stated Macao Gaming Equipment Manufacturers Association Chairman Jay Chun, after revealing recently that he was aware of at least four casino providers who were relocating overseas, with the Philippines having come up in multiple conversations.

“Macao has already lost its shine.”

Due to its size, the Philippines appears to be the most logical example compared to Singapore, where most Macau-based gambling companies would likely look to relocate if crackdowns continued in the province. Under Xi Jinping’s premiership, it was recently revealed that the number of slot machines in the province could exceed no more than 12,000, having previously been at 17,000.

From a supplier perspective, this would certainly hamstring potential future business, making the Philippines, possibly a much more palpable alternative, with Singapore being considerably more expensive.

There is already, perhaps, the perfect place in the country to house potential companies; Entertainment City (or E-City), is being billed as the ‘Vegas of the East’; a 100-acre strip, not too dissimilar from its Nevada-based cousin, that currently plays home to four integrated resorts projects, plus multiple gambling houses and casinos that operate with a PAGCOR license.

One of the biggest selling points for international customers, at least, is that it is a roll of dice away from Ninoy Aquino International Airport (NAIA) - great news for dedicated high-rollers who just want to jet in for a day and not have to worry about the hassle of a long journey.

It is understood that the Philippine regulatory authorities have made it mandatory for any foreign investor in E-City to spend at least $1 billion (USD) on their facilities and contribute towards the infrastructure. In addition to this, they also have to follow strict guidelines when it comes to the ratio of gaming tables to hotel rooms.

Reports indicate that E-City makes up for 50 percent of gross gaming revenues in the Philippines, which underlines just exactly how important the resort is considered to be. What has been noticeable over the last year is that the resort, in particular, has placed a key emphasis on VIPs and, as a result, caters to these in a major way.

Furthermore, this also works from a proxy-betting perspective, whereby agents inside the casino can place bets on behalf of someone outside the casino (illegal in the rest of Asia). These gamblers often do not play in mass markets.

As the country develops its gambling infrastructure further, it will be fascinating to see the extent to which foreign companies commit to their goals, especially with numerous builds planned over the next few months, especially in E-City.

One of the most prominent recent ones is Westside City Resorts, an ambitious township that will be situated in E-City, spanning well in excess of 31 hectares and boasting 1500 hotel rooms. A project that will cost upwards of $1 billion, it will become the fourth operational casino resort in the area and the fifth in the country, boasting 400 gaming tables and 1200 slot machines.

There is a lot of logic to suggest that gambling will mature in the country and really take off, regardless of any opposition. Should the gambling industry in the Philippines survive the next few years and not bow to opposition pressure, there is every reason to suggest that Entertainment City may just be the place to be seen.

Review this Blog

Leave a Comment

User Comments

comments for The Rising Philippines Gambling Market - Current State and Opportunities