Bipartisan Bill Seeks End to Federal Excise Tax on Sports Bets

A renewed effort is underway to abolish the federal excise tax on sports betting.

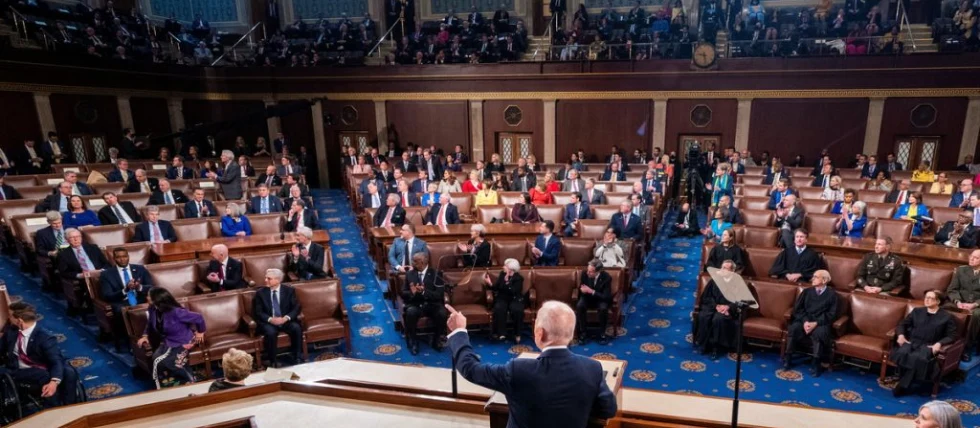

The bipartisan leaders of the Congressional Gaming Caucus have reintroduced legislation to remove the so-called “handle tax.” On Tuesday, Representatives Dina Titus and Guy Reschenthaler put forward the proposal once again, with the aim of scrapping the 0.25% tax imposed on all legal sports wagers.

Tax Introduced to Combat Illegal Gambling

The handle tax dates back to 1951 and was initially designed to combat illegal gambling through a 0.25% levy on all legally placed sports bets. Alongside this, the federal excise tax includes a $50 fee per sportsbook employee.

Reps. Titus and Reschenthaler have persistently advocated for the removal of the sportsbook tax and previously introduced similar bills in 2019, 2021, and 2023. Their efforts show the economic importance of legal sports betting, particularly since its rapid growth following the 2018 expansion. Their latest push hopes to relieve legal bookmakers of what they view as an outdated financial burden.

More Regulation News

Legal Operators Penalized While Illegal Market Thrives

Congressman Reschenthaler spoke of the gambling industry’s economic impact and highlighted that it employs more than one million people and generates more than $70 billion for state and local governments. Pennsylvania online casinos and sportsbooks, he said, support approximately 33,000 jobs.

Reschenthaler criticized the existing tax structure as outdated and harmful to legal businesses. He argues that by removing the tax, the industry will be able to support more jobs and promote economic growth.

His views were echoed by Congresswoman Titus, who argued that the tax unjustly penalizes legal operators while allowing illegal bookmakers, who are exempt from the 0.25% tax and the $50 per employee fee, to gain a competitive edge.

The Discriminatory Gaming Tax Repeal Act of 2025 repeals a tax that does nothing except penalize legal gaming operators for creating thousands of jobs in Nevada and 37 other states around the nation.

Titus also spoke of the lack of transparency surrounding the tax’s revenue use. She said that in response to her inquiry to the IRS about where the collected funds go, she was told that they didn’t know.

RELATED TOPICS: Regulation

Most Read

Must Read

Interviews

Interviews

Sweepstakes Casinos: Thriving in an Ever-Changing Industry – Interview with Attorney Stephen C. Piepgrass

Feb 17, 2025 Interviews

Interviews

Review this New Post

Leave a Comment

User Comments

Comments for Bipartisan Bill Seeks End to Federal Excise Tax on Sports Bets